Are you looking to invest in US stocks but reside in Canada? Investing in US stocks from Canada can be a strategic move, offering access to a diverse range of companies and potentially higher returns. This guide will provide you with a comprehensive overview of the process, benefits, and considerations when buying US stocks in Canada.

Understanding the Basics

When you invest in US stocks from Canada, you are essentially purchasing shares of a company that is listed on a US stock exchange. This can include the New York Stock Exchange (NYSE) or the NASDAQ. It's important to note that while you'll be purchasing US stocks, the returns will be in US dollars. This means that currency exchange rates will play a significant role in your investment returns.

How to Buy US Stocks in Canada

Open a Brokerage Account: The first step is to open a brokerage account that allows you to trade US stocks. Many Canadian brokerage firms offer this service, including TD Ameritrade, Questrade, and BMO InvestorLine.

Choose a Brokerage Account: When selecting a brokerage, consider factors such as fees, customer service, and the range of investment options available. Some brokers may offer specialized accounts for US stock trading, which can be beneficial.

Fund Your Account: Once your account is set up, you'll need to fund it. This can be done through bank transfers, cheques, or other methods provided by your brokerage.

Research and Select Stocks: Conduct thorough research to identify US stocks that align with your investment goals and risk tolerance. Utilize tools provided by your brokerage, such as stock screeners and financial news, to assist in your research.

Place Your Order: Once you've identified the stocks you want to buy, place your order through your brokerage platform. Be sure to understand the order types and how they will affect your investment.

Benefits of Buying US Stocks in Canada

Diversification: Investing in US stocks allows you to diversify your portfolio, reducing your exposure to a single market or sector.

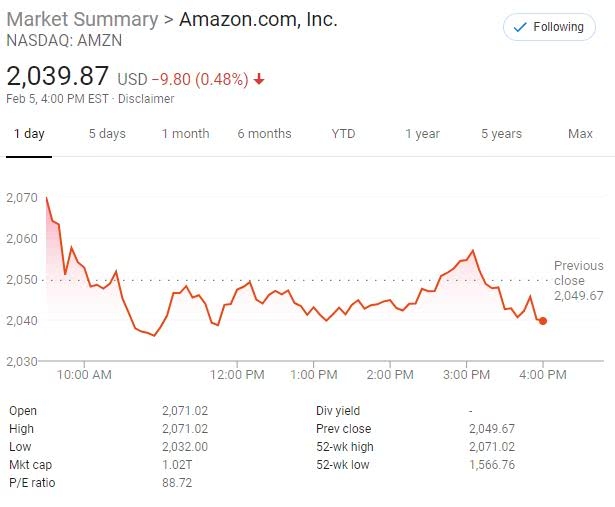

Access to Top Companies: The US stock market is home to some of the world's largest and most successful companies, such as Apple, Microsoft, and Amazon.

Potential for Higher Returns: Historically, the US stock market has offered higher returns than the Canadian market, making it an attractive option for investors seeking growth.

Considerations and Risks

Currency Exchange Rates: Fluctuations in the exchange rate can impact your investment returns. It's important to consider the potential for currency depreciation when investing in US stocks.

Tax Implications: Investing in US stocks from Canada may have tax implications. It's important to consult with a tax professional to understand the potential tax obligations.

Regulatory Differences: The regulatory environment for investing in US stocks from Canada may differ from Canadian regulations. Be sure to understand the rules and regulations that apply to your investments.

Case Study: Investing in US Tech Stocks

One popular strategy among Canadian investors is to invest in US tech stocks. Companies like Apple and Microsoft have consistently delivered strong returns over the years. By investing in these companies, Canadian investors can gain exposure to the rapidly growing tech industry.

Conclusion

Buying US stocks in Canada can be a valuable investment strategy. By following the steps outlined in this guide and considering the associated risks and benefits, you can make informed decisions and potentially achieve higher returns. Remember to do thorough research and consult with a financial advisor or tax professional before making any investment decisions.