Investing in US stocks has long been a popular choice for both individual investors and institutional investors. The United States is home to some of the largest and most successful companies in the world, making it an attractive market for investors seeking high returns. However, as with any investment, there are both advantages and disadvantages to consider. In this article, we will explore the pros and cons of investing in US stocks.

Pros of Investing in US Stocks

High Growth Potential: The US stock market is known for its strong growth potential. Many US companies are leaders in their respective industries and have the potential to grow significantly over time. This can lead to substantial returns for investors who buy shares at the right time.

Diversification Opportunities: The US stock market is incredibly diverse, offering a wide range of investment opportunities. Investors can choose from large-cap, mid-cap, and small-cap companies across various sectors such as technology, healthcare, finance, and consumer goods.

Access to Innovation: The US is a hub for innovation, with many cutting-edge companies operating in the market. Investing in US stocks can provide exposure to these innovative companies and their potential for future growth.

Strong Regulatory Framework: The US has a robust regulatory framework that protects investors and ensures fair and transparent markets. This provides investors with confidence in the market and their investments.

Market Liquidity: The US stock market is one of the most liquid in the world, making it easy for investors to buy and sell shares at any time. This liquidity provides flexibility and can help investors manage their investments effectively.

Cons of Investing in US Stocks

Market Volatility: The US stock market can be highly volatile, with significant price fluctuations over short periods. This volatility can be unsettling for some investors and may lead to losses if not managed properly.

Political Risk: The US is a politically charged environment, and political events can impact the stock market. Changes in government policies, trade wars, and other political uncertainties can create volatility and uncertainty in the market.

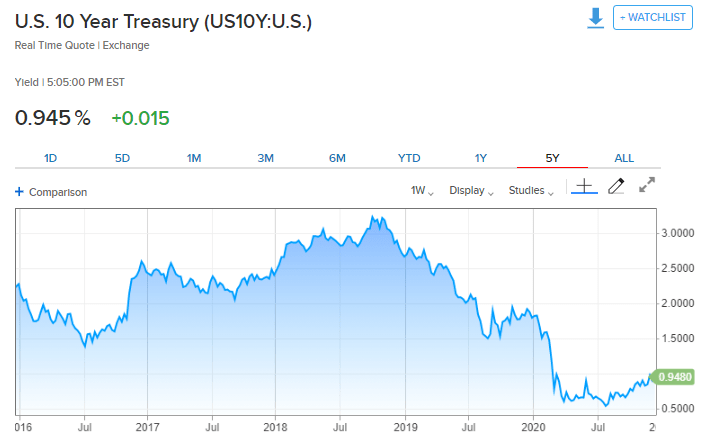

Economic Risk: Economic factors such as inflation, interest rates, and economic downturns can impact the performance of US stocks. These factors can lead to lower returns or even losses for investors.

Market Saturation: Some sectors in the US stock market may be saturated with companies, leading to increased competition and potentially lower growth rates for individual companies.

Tax Implications: Investing in US stocks may have tax implications, depending on the investor's residency and the type of investment. It's important for investors to understand the tax implications of their investments to avoid any surprises.

Case Study: Apple Inc.

One of the most successful companies in the US stock market is Apple Inc. Over the past decade, Apple has delivered impressive growth and has become one of the world's most valuable companies. However, investing in Apple has also come with its share of challenges. The company's stock price has experienced significant volatility, and investors who bought at the peak in 2018 and sold in 2019 saw substantial losses.

In conclusion, investing in US stocks offers numerous benefits, including high growth potential, diversification opportunities, and access to innovation. However, it also comes with risks such as market volatility, political and economic uncertainties, and tax implications. Investors should carefully consider these factors before deciding to invest in US stocks.