In recent years, U.S. dividend stocks have been a beacon of stability and reliability for investors seeking consistent income. However, the shine may be starting to fade as market dynamics shift. This article delves into the reasons behind this trend and what it means for investors.

Why Are U.S. Dividend Stocks Losing Their Luster?

One of the primary reasons for the decline in the appeal of U.S. dividend stocks is the rising interest rates. As the Federal Reserve continues to hike rates to combat inflation, the cost of borrowing increases, affecting corporate profitability. This, in turn, can lead to reduced dividend payments or even cuts.

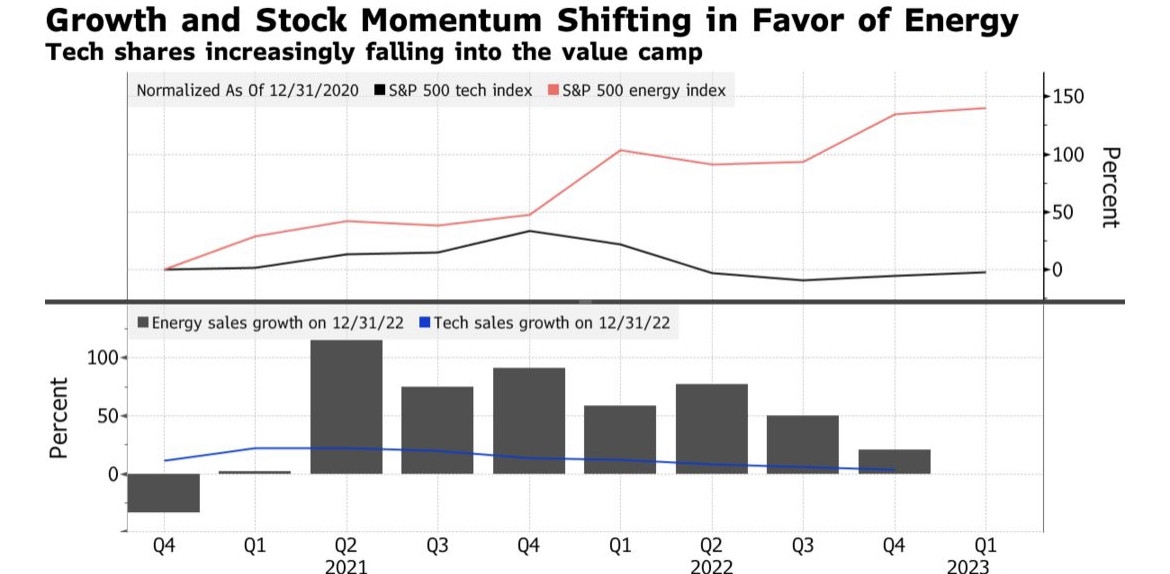

Another factor is the evolving market landscape. The rise of technology and other high-growth sectors has led to a shift in investor preferences. Many tech companies, for instance, have grown accustomed to reinvesting their earnings back into the business rather than distributing them as dividends.

Impact on Investors

For investors who rely on dividend income, the decline in U.S. dividend stocks can be a significant concern. Here’s how it might impact them:

- Reduced Income: With fewer companies paying dividends, investors may find it harder to maintain their desired level of income.

- Market Volatility: The increased risk associated with high-dividend stocks can lead to more volatility in investment portfolios.

- Opportunity Costs: Investors may miss out on potential gains in other sectors or asset classes.

What to Do Now

Despite the challenges, there are still opportunities for investors to generate income from the stock market. Here are some strategies to consider:

- Diversify: Diversifying your portfolio across various sectors and asset classes can help mitigate the impact of a decline in dividend stocks.

- Focus on Quality: Look for companies with strong fundamentals and a history of consistent dividend payments.

- Consider International Dividends: Investing in dividend-paying stocks from other countries can provide a diversification benefit and potentially higher yields.

Case Studies

To illustrate the impact of the shifting landscape, let’s look at two companies:

- Exxon Mobil Corporation (XOM): Once a staple in the dividend-paying landscape, Exxon Mobil has seen its dividend yield decline over the years. This is due to the company’s focus on reinvesting earnings into exploration and production activities.

- Apple Inc. (AAPL): Apple has long been known for its dividend payments, but the company has recently shifted its strategy. Instead of distributing earnings, Apple has been using its cash reserves to repurchase shares, leading to an increase in stock price.

In conclusion, while U.S. dividend stocks may be losing their luster, investors can still find opportunities for income and growth. By diversifying their portfolios, focusing on quality, and considering international investments, they can navigate the evolving market landscape.