Introduction:

The recent turmoil in the global financial markets has left many investors questioning the future of their portfolios. Amidst this uncertainty, US stock futures have shown signs of recovery, offering a glimmer of hope for investors. In this article, we will delve into the factors contributing to the US stock futures recovery and provide insights on how investors can navigate this volatile market.

Understanding the Recovery

US stock futures have experienced a significant downturn in the past few months, primarily due to the global economic slowdown and the COVID-19 pandemic. However, recent trends indicate a potential recovery, with several factors contributing to this turnaround.

Economic Stimulus: Governments around the world have been implementing various stimulus packages to support their economies. The US government, in particular, has allocated substantial funds to aid businesses and individuals affected by the pandemic. This has provided a much-needed boost to the stock market.

Improving Economic Data: As the pandemic continues to wane, economic data has started to show signs of improvement. For instance, the US unemployment rate has decreased, and consumer spending has picked up. These positive indicators have bolstered investor confidence.

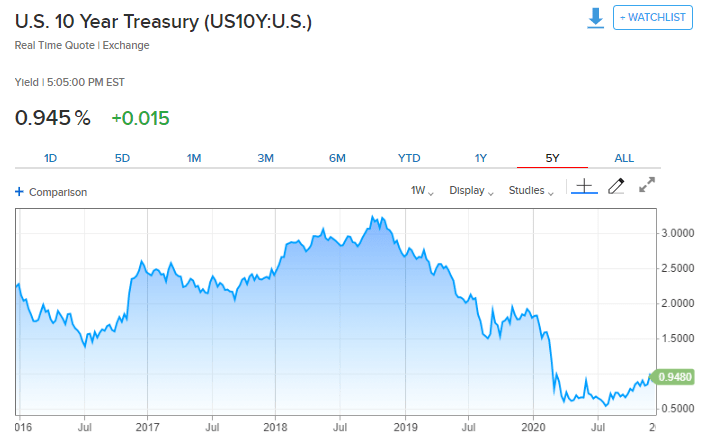

Central Bank Support: Central banks, including the Federal Reserve, have been implementing accommodative monetary policies to support the economy. These policies, such as interest rate cuts and quantitative easing, have helped stabilize the financial markets.

Investor Strategies

With the US stock futures showing signs of recovery, investors need to adopt a strategic approach to navigate this volatile market. Here are some key strategies:

Diversification: Diversifying your portfolio can help mitigate risks associated with market volatility. Consider investing in a mix of stocks, bonds, and other asset classes.

Quality Over Quantity: Focus on companies with strong fundamentals and a history of resilience. These companies are more likely to weather market downturns and benefit from the recovery.

Long-term Perspective: Avoid making impulsive decisions based on short-term market movements. Instead, maintain a long-term perspective and stay invested during market downturns.

Monitor Economic Indicators: Keep an eye on economic indicators, such as unemployment rates, consumer spending, and corporate earnings. These indicators can provide insights into the market's potential direction.

Case Studies

To illustrate the potential of the US stock futures recovery, let's consider a few case studies:

Apple Inc.: Despite the global economic slowdown, Apple Inc. has continued to perform well, with strong demand for its products. The company's shares have seen a significant increase, reflecting the recovery in the tech sector.

Amazon.com Inc.: Amazon has also thrived during the pandemic, with increased demand for its e-commerce services. The company's shares have seen substantial growth, highlighting the resilience of the tech sector.

Conclusion:

The US stock futures recovery presents an opportunity for investors to capitalize on market volatility. By adopting a strategic approach and focusing on quality investments, investors can navigate this volatile market and potentially benefit from the recovery. As the economic landscape continues to evolve, staying informed and adapting to market changes is crucial for long-term success.