The influx of Chinese investors in the US stock market has been a significant trend in recent years. With the growing economic power of China and the allure of the American market, this shift has implications for both investors and businesses. This article delves into the reasons behind this trend, the potential risks, and the opportunities it presents for both Chinese and American investors.

Reasons for the Surge

1. Economic Growth and Stability in China

China's rapid economic growth has made it a powerhouse in the global market. As the middle class continues to expand, Chinese investors are looking for new avenues to diversify their portfolios. The US stock market, known for its stability and growth potential, has become a popular destination.

2. Technology and Innovation

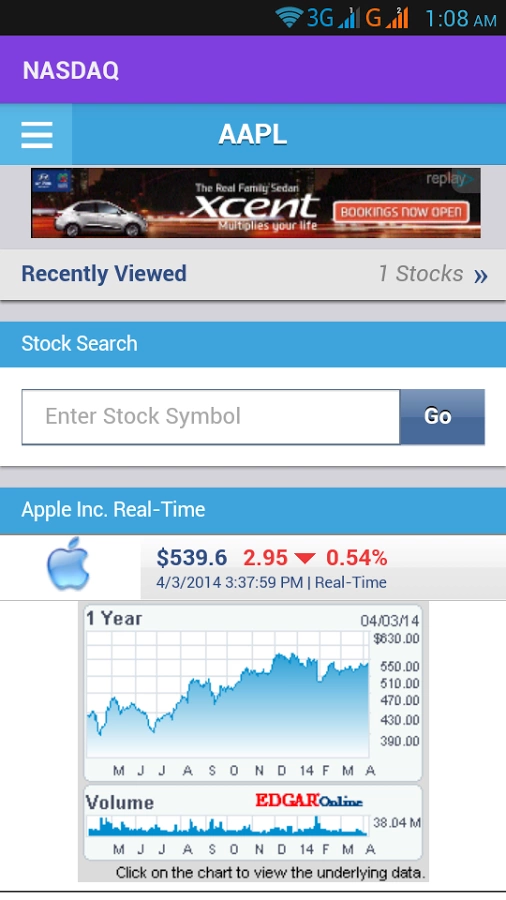

The US is a leader in technology and innovation, and Chinese investors are eager to tap into these sectors. Companies like Apple, Google, and Tesla have captured the imagination of Chinese investors, who see these companies as a way to gain exposure to cutting-edge technologies.

3. Yuan Devaluation

The devaluation of the Chinese yuan has made US stocks more attractive to Chinese investors. With the yuan losing value, investors are seeking higher returns in foreign currencies, and the US dollar remains a strong and stable option.

4. Regulatory Environment

The US has a well-established regulatory environment that provides Chinese investors with confidence. The transparency and legal framework of the US stock market make it an attractive destination for investors looking for a secure and reliable investment platform.

Potential Risks

1. Market Volatility

While the US stock market is known for its stability, it is not immune to volatility. Chinese investors should be prepared for market fluctuations and understand the risks associated with investing in US stocks.

2. Language and Cultural Barriers

Navigating the US stock market can be challenging for Chinese investors who are not familiar with the language and cultural nuances. It is crucial for these investors to seek professional advice and educate themselves about the market.

3. Regulatory Changes

Regulatory changes in the US can impact Chinese investors. Staying informed about these changes is essential to mitigate potential risks.

Opportunities

1. Diversification

Investing in US stocks allows Chinese investors to diversify their portfolios, reducing their exposure to domestic market risks.

2. Higher Returns

The US stock market has historically offered higher returns than the Chinese market, making it an attractive option for investors seeking growth.

3. Access to Global Brands

Chinese investors can gain access to global brands and innovative technologies by investing in US stocks.

Case Study: Alibaba

One of the most prominent examples of Chinese investment in the US stock market is Alibaba. The company's initial public offering (IPO) in 2014 was the largest in US history, raising $21.8 billion. This event highlighted the growing interest of Chinese investors in the US stock market.

In conclusion, the surge of Chinese investors in US stocks is driven by economic growth, technological innovation, and the allure of the American market. While there are risks involved, the opportunities for diversification and higher returns make it an attractive option for Chinese investors. By understanding the market and seeking professional advice, these investors can navigate the US stock market successfully.