Introduction:

In the world of firearms, Beretta is a name that stands out. The Italian firearm manufacturer has a rich history and a reputation for producing high-quality guns. For investors and firearm enthusiasts alike, keeping an eye on Beretta US stock prices can be a valuable endeavor. This article will delve into the factors that influence Beretta's stock prices, provide historical data, and offer insights into future trends.

Understanding Beretta US Stock Prices:

Beretta's stock prices, like those of any publicly-traded company, are influenced by various factors. These factors include the company's financial performance, market conditions, industry trends, and global events. To gain a better understanding of Beretta's stock prices, let's explore these factors in more detail.

- Financial Performance:

Beretta's financial performance is a key driver of its stock prices. The company's quarterly and annual reports provide valuable insights into its revenue, profit margins, and growth prospects. A strong financial performance can lead to higher stock prices, while poor performance can result in a decline.

Case Study: In 2018, Beretta announced that it had achieved record revenue of €1.2 billion, marking a 5% increase compared to the previous year. This positive financial performance contributed to an increase in its stock prices.

- Market Conditions:

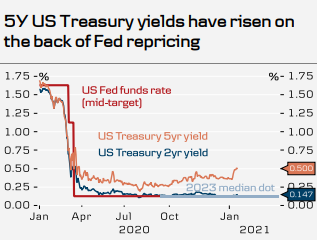

The overall market conditions also play a significant role in influencing Beretta's stock prices. When the market is performing well, stock prices tend to rise, and vice versa. Economic indicators, such as interest rates, inflation, and consumer confidence, can impact market conditions.

- Industry Trends:

The firearms industry is subject to various trends that can affect Beretta's stock prices. For instance, an increase in demand for self-defense firearms due to rising crime rates can positively impact Beretta's sales and, subsequently, its stock prices.

- Global Events:

Global events, such as political instability, economic sanctions, or changes in international trade policies, can also influence Beretta's stock prices. These events can impact the company's operations, supply chain, and overall business environment.

Historical Data:

To understand Beretta's stock prices, it is helpful to look at historical data. Over the past few years, Beretta's stock prices have exhibited a certain level of volatility. However, a general upward trend can be observed, especially when considering the company's strong financial performance.

Future Trends:

Looking ahead, several factors could impact Beretta's stock prices. These include:

- The expansion of the company's global market presence

- The launch of new products and innovations

- The ongoing recovery of the firearms industry

Conclusion:

Beretta US stock prices are influenced by a variety of factors, including the company's financial performance, market conditions, industry trends, and global events. By staying informed about these factors and analyzing historical data, investors and enthusiasts can better understand the potential for future growth and make informed decisions. As always, it is essential to conduct thorough research and consult with a financial advisor before making any investment decisions.