In 2017, the US stock market experienced a period of rapid growth, raising concerns about the potential for a bubble. This article delves into the factors contributing to this rise, the impact on investors, and the lessons learned from this pivotal year.

Rising Stock Market in 2017

The year 2017 marked a period of strong economic growth and low unemployment rates in the United States. This positive economic climate led to a surge in investor confidence, driving the stock market to new heights. Key factors contributing to this rise included:

- Low-interest rates: The Federal Reserve kept interest rates at historically low levels, making borrowing cheaper for businesses and consumers, which in turn fueled economic growth and investment.

- Corporate earnings: Companies reported strong earnings, with many businesses benefiting from the tax cuts implemented by the Trump administration.

- Strong economic data: Positive economic indicators, such as low unemployment and rising consumer spending, further bolstered investor confidence.

The Bubble Concerns

Despite the strong performance, some experts warned that the rapid growth in the stock market could lead to a bubble. Several factors contributed to these concerns:

- Valuation: Many stocks were trading at historically high valuations, raising concerns that they were overvalued.

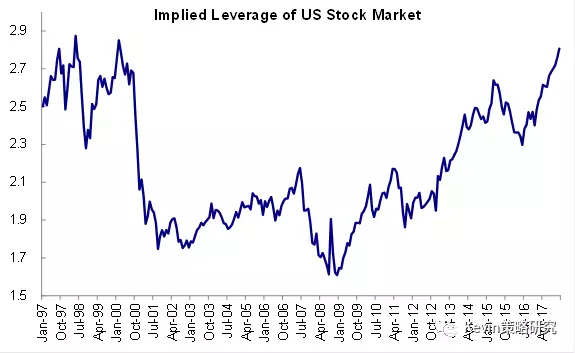

- Leverage: Some investors were using high levels of leverage to finance their investments, which increased the risk of a market crash if the market turned downward.

- Market sentiment: The "animal spirits" of investors, driven by optimism and greed, could lead to a speculative bubble.

Impact on Investors

The 2017 stock market bubble had a significant impact on investors. Those who invested early in the year saw substantial gains, while those who waited or entered late in the market may have missed out on the biggest returns. Additionally, the bubble created uncertainty and anxiety among investors, as they worried about the potential for a market crash.

Lessons Learned

The 2017 stock market bubble serves as a reminder of the importance of risk management and diversification. Here are some key lessons learned:

- Diversify your portfolio: Don't put all your eggs in one basket. Diversifying your investments can help reduce the risk of a significant loss.

- Understand your investments: Make sure you understand the risks and potential rewards of the investments you're making.

- Stay disciplined: Avoid making impulsive decisions based on market sentiment or fear.

Case Studies

Several companies experienced significant growth during the 2017 stock market bubble, including:

- Amazon: The online retailer saw its stock price surge by more than 50% in 2017.

- Apple: The tech giant's stock price also experienced a strong rally, with gains of over 40%.

- Tesla: The electric vehicle manufacturer's stock price skyrocketed, doubling in value during the year.

While these companies benefited from the bubble, it's important to note that not all stocks performed well. Many companies experienced significant losses as the bubble burst.

In conclusion, the 2017 stock market bubble serves as a valuable lesson for investors. By understanding the factors contributing to market bubbles and staying disciplined in their investment strategies, investors can minimize the risk of losing their hard-earned money.