In the ever-evolving landscape of the technology industry, ARM Holdings plc (ARM) has emerged as a major player, known for its cutting-edge semiconductor and software design technologies. The ARM stock price has been a topic of interest for investors and tech enthusiasts alike. In this article, we will delve into the factors influencing the ARM stock price, its recent performance, and what it means for investors looking to invest in this innovative company.

Understanding the ARM Stock Price

The ARM stock price, which is listed on the London Stock Exchange (LSE) and the NASDAQ Global Select Market, is influenced by a variety of factors. These include the company's financial performance, market trends, and broader economic conditions. Here's a closer look at some of the key factors:

- Financial Performance: ARM's revenue and profit margins are closely monitored by investors. A strong financial performance, with increasing revenue and profit margins, can drive the stock price higher.

- Market Trends: The demand for ARM's technology in the semiconductor and software industries can significantly impact the stock price. Trends such as the rise of mobile devices, IoT, and cloud computing can positively influence ARM's growth prospects.

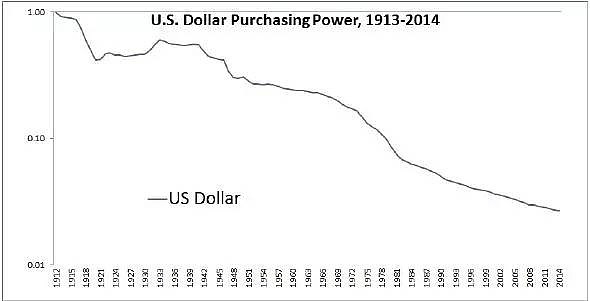

- Economic Conditions: Economic factors, such as inflation, interest rates, and global economic stability, can affect the ARM stock price. A stable and growing economy is generally beneficial for the company's performance.

Recent Performance of ARM Stock

In recent years, the ARM stock price has experienced periods of volatility. However, overall, the stock has shown strong growth potential. Here are some key points regarding its recent performance:

- Revenue Growth: ARM has reported consistent revenue growth, driven by its partnerships with leading technology companies and the increasing demand for its technology.

- Profit Margins: The company has maintained healthy profit margins, with a focus on improving its operational efficiency.

- Dividend Payments: ARM has a history of paying dividends to its shareholders, which can provide a steady income stream for investors.

Case Studies: ARM's Impact on the Technology Industry

ARM's technology has had a significant impact on the technology industry. Here are a few examples:

- Apple's iPhone: ARM's technology powers the processors used in Apple's iPhone, contributing to its high performance and energy efficiency.

- IoT Devices: ARM's technology is widely used in IoT devices, enabling seamless connectivity and improved performance.

- Cloud Computing: ARM's processors are increasingly being used in cloud computing environments, providing efficient and scalable solutions.

Conclusion

The ARM stock price is a reflection of the company's strong financial performance, market trends, and its significant impact on the technology industry. While the stock may experience periods of volatility, its long-term growth potential remains promising. Investors looking to invest in the technology sector should consider ARM as a potential investment opportunity.

- ARM Holdings plc (ARM): The company's official website, which provides detailed information about its products, services, and financial performance.

- London Stock Exchange (LSE): The LSE website, where ARM's stock is listed and where investors can access real-time stock prices and market data.

- NASDAQ Global Select Market: The NASDAQ website, where ARM's stock is also listed and where investors can access market data and news about the company.