In the ever-evolving global economy, the United States' tariff policies have a significant impact on non-US stock markets. These policies can either bolster or diminish the performance of foreign equities, depending on the nature of the tariffs and the sectors they affect. This article delves into the intricacies of how tariffs influence non-US stock markets, providing insights into the potential risks and opportunities they present.

Understanding Tariffs

Tariffs are taxes imposed on imported goods and services. They are used to protect domestic industries from foreign competition, generate revenue for the government, or as a retaliatory measure against other countries' trade policies. While tariffs can benefit certain domestic industries, they often have a ripple effect on international markets, including non-US stock markets.

Impact on Non-US Stock Markets

- Sector-Specific Effects

Tariffs can have a profound impact on specific sectors within non-US stock markets. For example, if the U.S. imposes tariffs on steel imports, it could negatively affect steel-producing companies in countries like China and Europe. Conversely, companies that supply components to the steel industry might benefit from increased demand due to higher steel prices.

- Currency Fluctuations

Tariffs can also influence currency exchange rates, which in turn affect non-US stock markets. A stronger U.S. dollar can make imports cheaper and exports more expensive, impacting companies with significant international exposure. For instance, if the U.S. dollar strengthens against the Euro, European companies with U.S. operations might experience lower profits.

- Global Supply Chains

The interconnected nature of global supply chains means that tariffs can have a cascading effect on non-US stock markets. For example, if the U.S. imposes tariffs on Chinese electronics, it could disrupt the supply chains of companies in other countries that rely on Chinese components.

Case Studies

- China-US Trade War

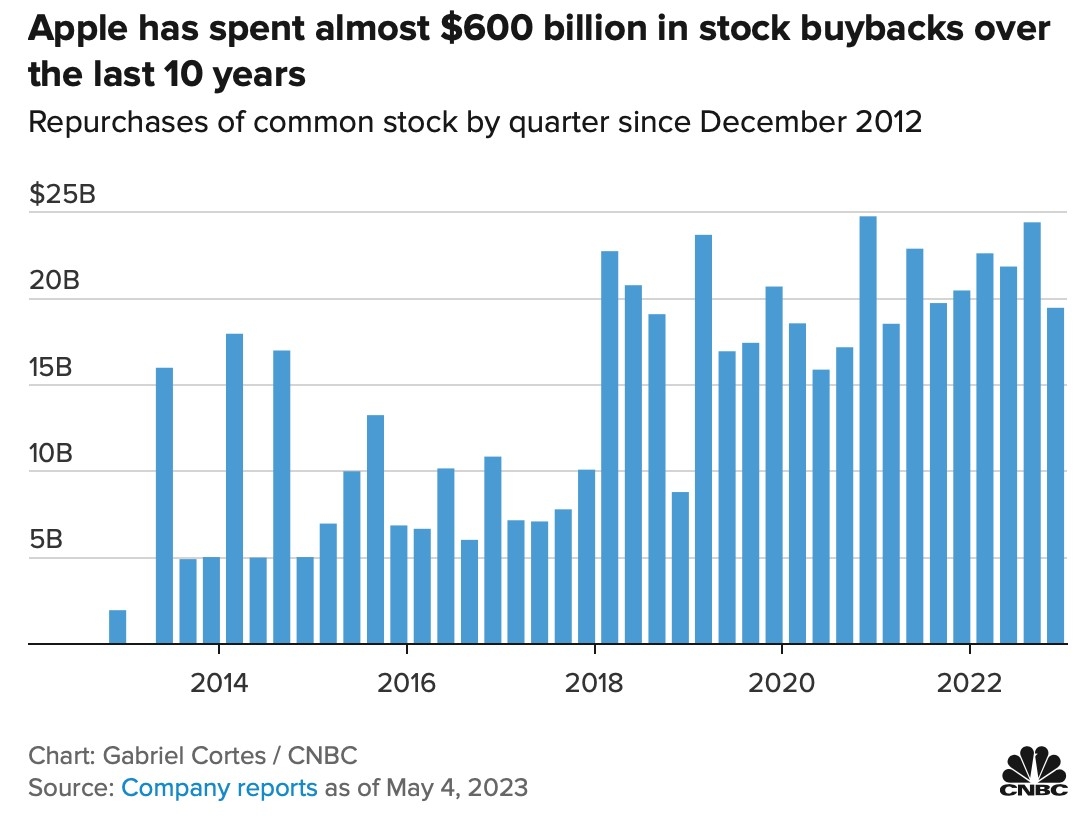

The ongoing trade war between the U.S. and China has had a significant impact on non-US stock markets. Companies with significant exposure to the Chinese market, such as Apple and Tesla, have seen their stock prices fluctuate as a result of tariffs and trade tensions.

- EU Tariffs on U.S. Goods

In response to U.S. tariffs on steel and aluminum, the European Union (EU) imposed retaliatory tariffs on a range of U.S. goods, including agricultural products. This has had a negative impact on U.S. companies with operations in the EU, such as Boeing and McDonald's.

Conclusion

Tariffs can have a profound impact on non-US stock markets, affecting everything from individual companies to entire sectors. While tariffs can provide opportunities for some, they also pose significant risks. Investors must stay informed about global trade policies and their potential impact on their investments.