The US stock market has always been a beacon of economic activity and investment opportunity. As we step into 2025, it is essential to understand the factors that will shape the market and influence investor decisions. This article delves into the key drivers that are likely to impact the US stock market in the coming years.

Economic Growth and Interest Rates

Economic growth remains a critical factor in driving stock market performance. In 2025, the US economy is expected to continue its steady growth trajectory, bolstered by factors such as low unemployment rates and robust consumer spending. However, the impact of economic growth on the stock market is not always straightforward. For instance, as the economy grows, companies may face increased competition and pricing pressures, which could lead to lower profit margins.

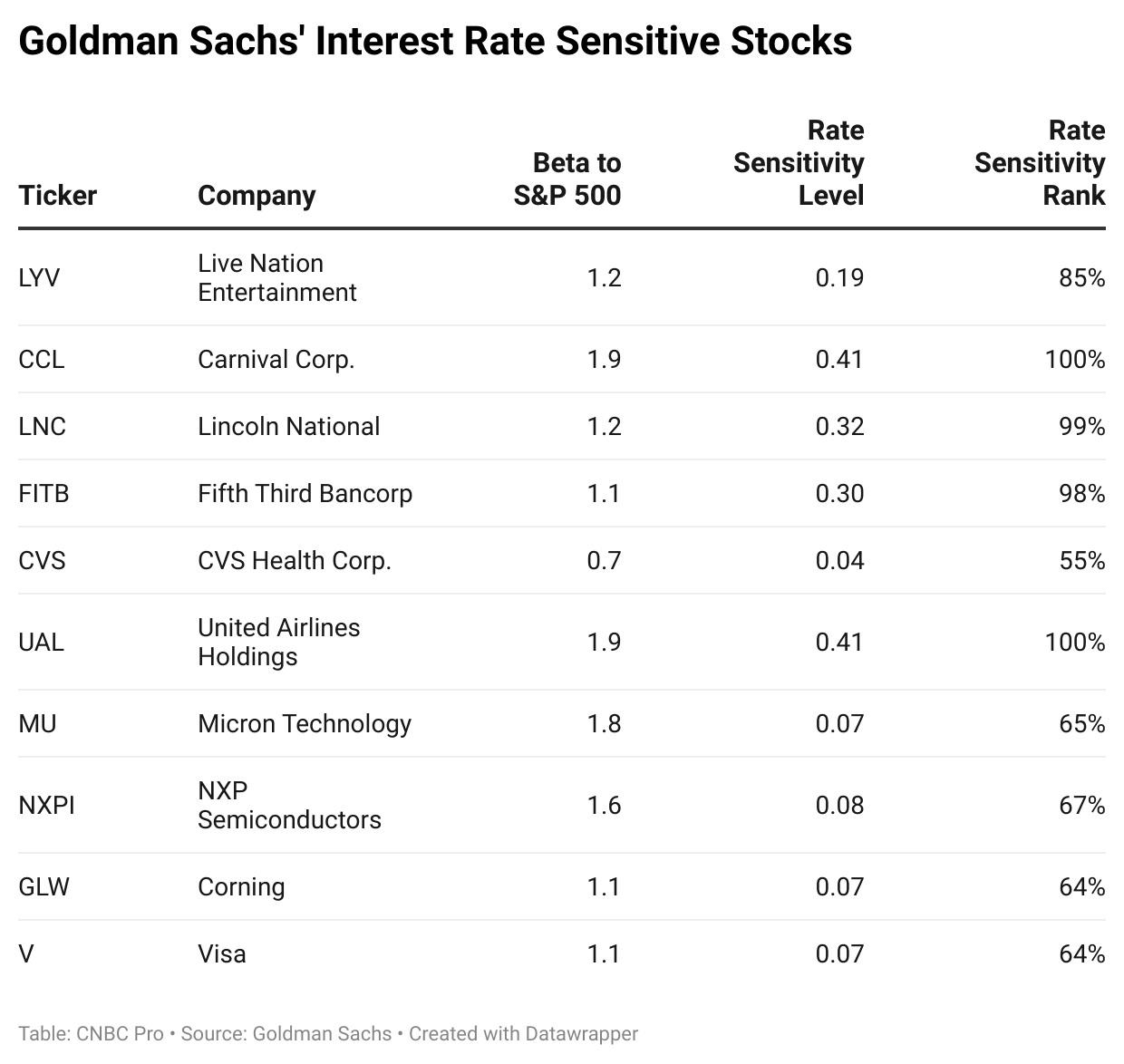

Interest rates play a crucial role in the stock market's performance. The Federal Reserve's monetary policy decisions can significantly impact investor sentiment and market dynamics. In 2025, the Fed is expected to continue its gradual tightening of interest rates. This could lead to higher borrowing costs for companies, potentially reducing their profit margins and affecting stock prices.

Technological Advancements and Disruptions

Technological advancements are a major driver of stock market performance. In 2025, artificial intelligence (AI), machine learning, and blockchain technology are likely to play a significant role in shaping the market. Companies at the forefront of these technologies are expected to see significant growth, while those lagging behind may struggle to keep up.

Moreover, technological disruptions can have a profound impact on the stock market. For example, the rise of electric vehicles has already begun to reshape the automotive industry. Companies that fail to adapt to these changes may find themselves on the wrong side of the market.

Global Economic Environment

The global economic environment is another key factor influencing the US stock market. In 2025, geopolitical tensions and trade disputes are likely to remain a concern. These issues can lead to uncertainty and volatility in the market, affecting investor sentiment and stock prices.

Regulatory Changes

Regulatory changes can also significantly impact the stock market. In 2025, financial regulation and corporate governance are expected to remain focal points. Changes in regulations can affect the profitability of companies and their ability to operate, thus impacting their stock prices.

Case Studies

To illustrate these factors, let's consider a few case studies:

- Tesla: As a leader in electric vehicles and renewable energy solutions, Tesla has seen significant growth in recent years. However, its success has also been attributed to technological innovation and regulatory support in the renewable energy sector.

- Amazon: Amazon's expansion into various sectors, including cloud computing and e-commerce, has contributed to its strong performance in the stock market. However, increased competition and regulatory scrutiny have also posed challenges.

Conclusion

In 2025, the US stock market will be influenced by a variety of factors, including economic growth, technological advancements, global economic conditions, and regulatory changes. Investors need to stay informed and be prepared to adapt to these changing dynamics. By understanding these factors, investors can make more informed decisions and navigate the complexities of the stock market in 2025 and beyond.