Introduction: The stock market is a dynamic entity that reflects the economic health and investor sentiment of a country. The US stock market, in particular, has been a beacon of global financial activity. In this article, we delve into the current stock market US trend, analyzing the factors influencing it and providing insights into the potential future direction.

Market Performance Overview

As of the latest data, the US stock market has shown remarkable resilience in the face of various challenges. The S&P 500 has been a key indicator of the market's performance, with significant gains over the past year. This trend can be attributed to several factors, including strong corporate earnings, low-interest rates, and a robust economic outlook.

Inflation and Interest Rates

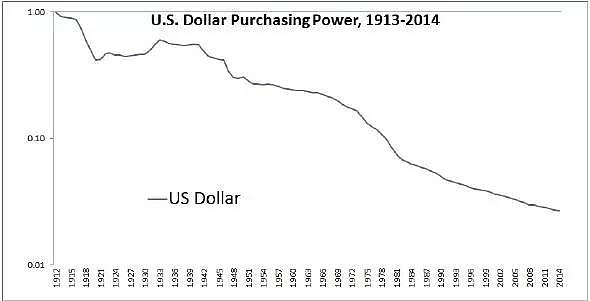

One of the primary factors affecting the stock market is inflation. The US Federal Reserve has been closely monitoring inflation levels, and recent data suggests that it remains within the target range. However, there are concerns about potential inflationary pressures in the coming months. This has led to fluctuations in the stock market, with investors closely watching the Fed's policy decisions.

Economic Outlook

The US economy has shown remarkable strength in recent years, with low unemployment rates and steady GDP growth. This positive economic outlook has supported the stock market, as investors remain optimistic about the future. However, there are risks, including geopolitical tensions and trade disputes, that could impact the economic landscape.

Sector Performance

Different sectors within the stock market have shown varying performance trends. Technology stocks, for example, have been a significant driver of growth, with companies like Apple and Microsoft leading the way. On the other hand, sectors like energy and financials have faced challenges due to various factors, including lower oil prices and regulatory changes.

Investor Sentiment

Investor sentiment plays a crucial role in the stock market's direction. Optimism and confidence tend to drive markets higher, while pessimism and uncertainty can lead to corrections. Currently, investor sentiment remains positive, with many investors believing that the stock market's upward trend will continue.

Case Studies

To better understand the stock market's trend, let's look at a couple of case studies. The first is Tesla, an electric vehicle manufacturer that has seen significant growth in its stock price over the past few years. This growth can be attributed to the company's innovative products, strong demand for electric vehicles, and the overall bullish sentiment in the technology sector.

The second case study is Walmart, a retail giant that has faced challenges due to increased competition from online retailers. Despite these challenges, Walmart's stock has remained relatively stable, driven by its strong fundamentals and diversified business model.

Conclusion:

The current stock market US trend suggests a strong and resilient market, with potential for further growth. However, investors should remain vigilant about the various factors that can impact the market, including inflation, interest rates, and economic outlook. By staying informed and making informed decisions, investors can navigate the stock market's trends and potentially achieve their financial goals.