Are you considering investing in US stocks from Singapore? If so, you've come to the right place. Investing in foreign stocks can be a lucrative venture, especially when you have access to the world's largest and most diverse stock market. This guide will provide you with essential information on how to invest in US stocks from Singapore, including the benefits, risks, and the steps to get started.

Why Invest in US Stocks from Singapore?

The US stock market is renowned for its liquidity, diversity, and innovation. By investing in US stocks, you can gain exposure to some of the world's most successful companies, such as Apple, Google, and Microsoft. Additionally, investing in US stocks can offer several advantages:

- Diversification: Investing in US stocks allows you to diversify your portfolio, reducing your exposure to local market risks.

- Potential for High Returns: The US stock market has historically provided higher returns than many other markets.

- Access to Cutting-Edge Companies: The US is home to numerous cutting-edge companies in various industries, such as technology, healthcare, and finance.

Understanding the Risks

While investing in US stocks from Singapore offers numerous benefits, it's essential to be aware of the risks involved:

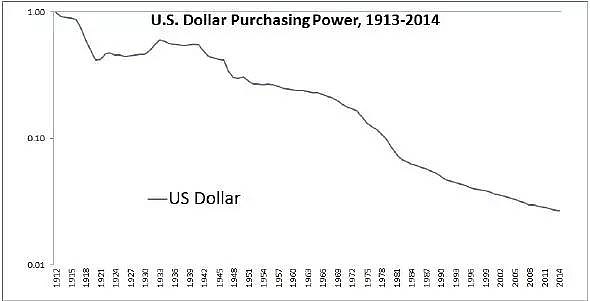

- Currency Fluctuations: Exchange rate fluctuations can impact the returns on your investments.

- Regulatory Differences: The regulatory environment in the US may differ from that in Singapore, which could affect your investment decisions.

- Market Volatility: The US stock market can be highly volatile, leading to significant price fluctuations.

Steps to Invest in US Stocks from Singapore

Open a Brokerage Account: To invest in US stocks from Singapore, you'll need to open a brokerage account with a reputable online broker. Some popular options include TD Ameritrade, E*TRADE, and Charles Schwab.

Understand the Tax Implications: Before investing, it's crucial to understand the tax implications of investing in US stocks from Singapore. The US government imposes a 30% withholding tax on dividends paid to non-US residents. However, many countries, including Singapore, have tax treaties with the US that reduce or eliminate this tax.

Research and Analyze Companies: Conduct thorough research on the companies you're interested in investing in. Analyze their financial statements, market position, and growth prospects.

Diversify Your Portfolio: To mitigate risks, diversify your portfolio by investing in various sectors and geographical regions.

Monitor Your Investments: Regularly monitor your investments to ensure they align with your investment goals and risk tolerance.

Case Study: Investing in Apple from Singapore

Let's consider a hypothetical scenario where you decide to invest in Apple Inc. (AAPL) from Singapore. After conducting thorough research, you determine that Apple is a strong investment with a solid track record of growth and innovation.

- Open a Brokerage Account: You open a brokerage account with a reputable online broker that offers access to US stocks.

- Understand the Tax Implications: You consult with a tax professional to understand the tax implications of investing in Apple from Singapore.

- Research and Analyze Apple: You analyze Apple's financial statements, market position, and growth prospects.

- Invest in Apple: You purchase shares of Apple through your brokerage account.

- Monitor Your Investment: You regularly monitor your investment to ensure it aligns with your investment goals and risk tolerance.

By following these steps, you can successfully invest in US stocks from Singapore and potentially benefit from the world's largest and most diverse stock market.