Introduction: The recent US election has undoubtedly had a significant impact on the stock market. Investors and analysts alike have been closely monitoring the market's performance to gauge the potential implications of the election results. In this article, we will delve into the stock market's behavior since the election and analyze the key factors that have influenced its trajectory.

Market Performance Post-Election:

Since the US election, the stock market has exhibited a mixed performance. While some sectors have seen impressive gains, others have experienced setbacks. It is crucial to understand the reasons behind these fluctuations to make informed investment decisions.

Sector Performance:

Technology Stocks: Technology stocks have been one of the major winners since the election. The tech sector's strong performance can be attributed to the increasing demand for digital solutions and remote work arrangements. Notable tech companies such as Apple, Microsoft, and Amazon have seen significant gains.

Healthcare Stocks: The healthcare sector has also experienced a surge in stock prices. This can be attributed to the growing importance of healthcare services and the potential for increased government spending on healthcare in the upcoming years.

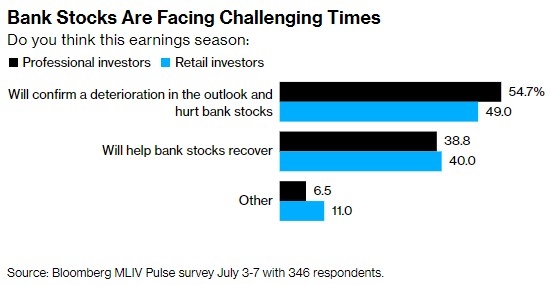

Financial Stocks: The financial sector has seen mixed results since the election. While some financial institutions have benefited from the election results, others have faced challenges. This can be attributed to the varying policies and regulations proposed by the new administration.

Key Factors Influencing the Stock Market:

Policy Changes: The election has led to a shift in policies, which has had a direct impact on the stock market. Investors are closely monitoring policy changes, including tax reforms, trade agreements, and regulatory changes, to assess their potential impact on the market.

Economic Data: The release of economic data, such as GDP growth, unemployment rates, and inflation, plays a crucial role in shaping the stock market's trajectory. Investors use these data points to gauge the overall economic health and make informed decisions.

Geopolitical Factors: Geopolitical tensions and global events can also influence the stock market. Investors are closely monitoring developments in international relations and trade to assess their potential impact on the market.

Case Studies:

Tesla (TSLA): Tesla, an electric vehicle manufacturer, has seen a significant surge in stock prices since the election. This can be attributed to the company's expansion plans and the increasing demand for electric vehicles. The election's impact on clean energy policies has also played a role in Tesla's stock performance.

United Airlines (UAL): United Airlines has faced challenges since the election, with its stock prices experiencing a downward trend. This can be attributed to the company's exposure to the airline industry, which has been hit hard by the pandemic. Additionally, the election's impact on travel restrictions and airline policies has contributed to United Airlines' stock performance.

Conclusion: The stock market's performance since the US election has been influenced by a variety of factors, including sector-specific trends, policy changes, and economic data. Investors must stay informed and analyze these factors to make informed decisions. As the market continues to evolve, it is crucial to monitor key indicators and stay adaptable to changes.