In the financial world, stability is often a sign of a healthy market. On Tuesday, the US stock futures market showcased just that, with futures hovering steady. This article delves into the reasons behind this steady performance and its implications for the broader market.

Steady Performance Amid Global Uncertainties

Despite the global uncertainties, including geopolitical tensions and economic fluctuations, the US stock futures remained steady. This steady performance can be attributed to several factors.

1. Strong Corporate Earnings Reports

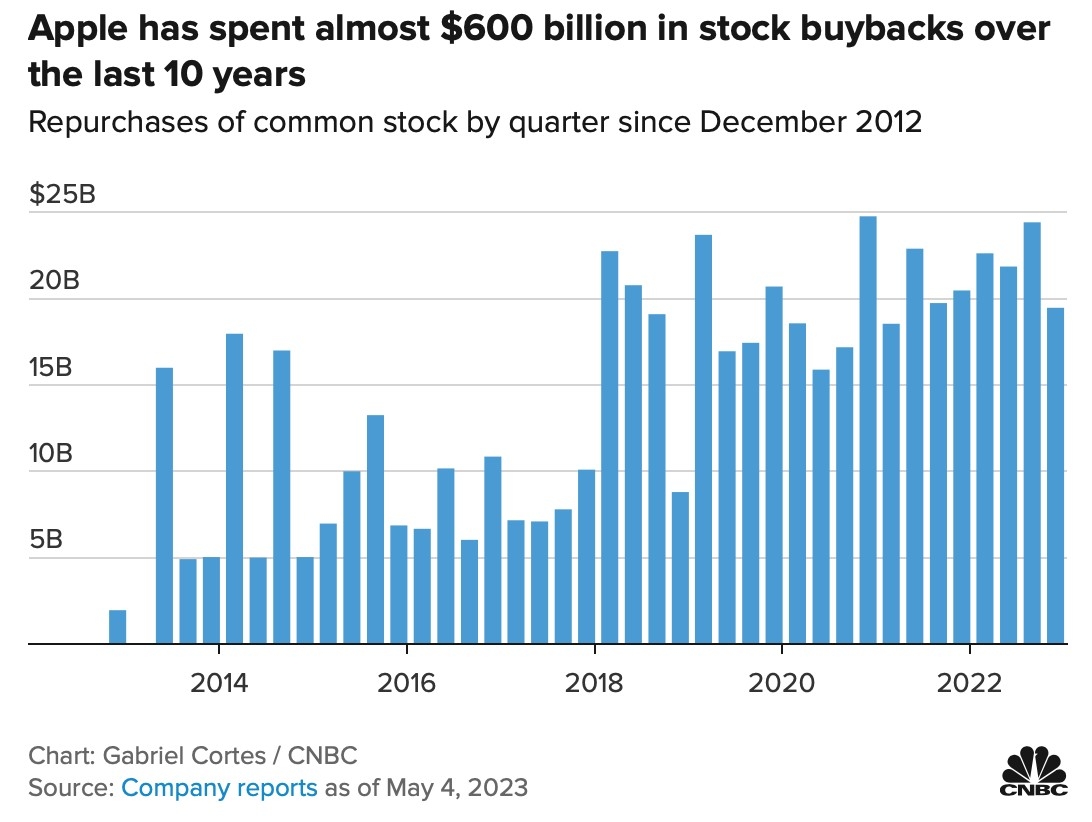

One of the primary reasons for the steady performance of US stock futures is the strong corporate earnings reports. Many companies have reported better-than-expected earnings, which has boosted investor confidence. For instance, Apple reported its highest revenue and earnings in the company's history, which positively impacted the futures market.

2. Economic Data

Another factor contributing to the steady performance is the positive economic data. The latest job reports, consumer spending, and inflation data have all been encouraging, suggesting a robust economic recovery. This economic optimism has supported the stock futures market.

3. Low Interest Rates

The low-interest-rate environment has also played a significant role in the steady performance of US stock futures. With the Federal Reserve maintaining low interest rates, investors have been flocking to the stock market in search of higher returns.

Implications for the Broader Market

The steady performance of US stock futures has several implications for the broader market.

1. Increased Investor Confidence

The steady performance has bolstered investor confidence, leading to increased investment in the stock market. This increased investment can drive the market higher, potentially leading to a bull market.

2. Attracting Foreign Investors

The steady performance of the US stock market has also attracted foreign investors. These investors are looking for opportunities in a stable and growing market, which can further boost the market's performance.

3. Impact on Other Asset Classes

The steady performance of the US stock futures market can also impact other asset classes, such as bonds and real estate. As investors move away from these asset classes in favor of stocks, their prices may decline.

Case Study: Tesla's Impact on Stock Futures

A prime example of how individual companies can impact the stock futures market is the case of Tesla. When Tesla reported its earnings, the stock futures market reacted positively, showcasing the influence of high-profile companies on the broader market.

Conclusion

The steady performance of US stock futures on Tuesday is a testament to the resilience and strength of the US stock market. With strong corporate earnings, positive economic data, and low-interest rates, the market is well-positioned for continued growth. As investors remain optimistic, the stock futures market is likely to remain steady, offering opportunities for both short-term traders and long-term investors.