The financial markets have been abuzz with anticipation as the much-anticipated Personal Consumption Expenditures (PCE) inflation data approaches. In this article, we delve into the current state of US stock futures, analyzing the factors contributing to their stabilization and the implications of the upcoming inflation report.

Market Stability and Economic Indicators

US stock futures have shown remarkable stability in recent days, defying the usual pre-data volatility. This stability can be attributed to a combination of factors, including robust economic indicators and cautious investor sentiment.

Robust Economic Indicators

Several economic indicators have recently pointed to a strong US economy. The latest jobs report showed a significant increase in non-farm payroll, while the unemployment rate remained at a low level. Additionally, consumer spending has been robust, reflecting a confident consumer sentiment.

Cautious Investor Sentiment

Despite the strong economic indicators, investors remain cautious. The upcoming PCE inflation data is a critical factor that could sway market sentiment. With inflation at a multi-decade high, investors are keenly aware of the potential risks associated with rising prices.

The PCE Inflation Data

The PCE inflation data is a key indicator of inflation trends in the US economy. This report measures the prices paid by consumers for goods and services and is widely considered to be a more accurate reflection of inflation than the Consumer Price Index (CPI).

Implications for US Stock Futures

The upcoming PCE inflation data could have significant implications for US stock futures. If the inflation rate remains high, it could lead to further interest rate hikes by the Federal Reserve, potentially slowing down economic growth. This could negatively impact stock prices, leading to increased volatility in the market.

On the other hand, if the inflation rate shows signs of cooling, it could boost investor confidence and lead to a rally in stock futures. This scenario is seen as more likely by many market analysts, given the current economic conditions.

Case Studies: Historical Inflation Data and Stock Market Performance

To better understand the relationship between inflation data and stock market performance, let's look at a couple of historical case studies.

In 2021, the PCE inflation rate rose to a 30-year high. However, the stock market remained resilient, with the S&P 500 index reaching new highs. This indicates that while inflation can be a concern, it may not always have a negative impact on stock prices.

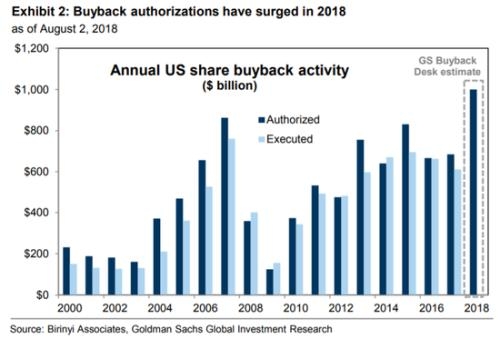

In 2018, the PCE inflation rate was well below the current levels. However, the stock market experienced significant volatility, with the S&P 500 index dropping by nearly 20% during the year. This highlights the importance of considering other economic factors, such as trade tensions and geopolitical risks, when analyzing stock market performance.

Conclusion

As the PCE inflation data approaches, US stock futures have shown remarkable stability. While the upcoming report is a critical factor in determining market sentiment, it's important to consider the broader economic context and historical precedents. With a cautious approach and a focus on long-term investment strategies, investors can navigate the challenges and opportunities presented by the current economic environment.