Jeffrey Gundlach, the renowned CEO of DoubleLine Capital, has been a prominent figure in the financial world for years. His insights on the US stock market have often been sought after by investors and analysts alike. In this article, we delve into Gundlach's views on the current state of the US stock market and his predictions for the future.

Understanding the Current Market Landscape

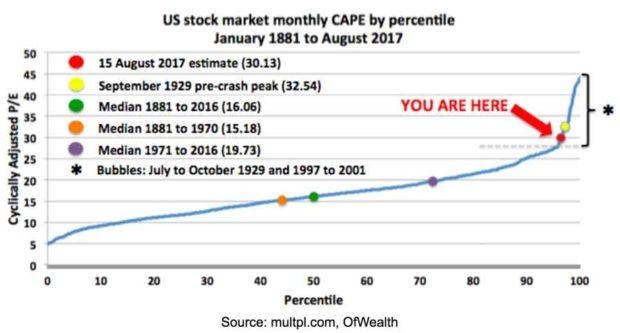

Gundlach has been vocal about his concerns regarding the current US stock market. He argues that the market is overvalued and that investors should be cautious. "The stock market is in a bubble," he recently stated. "We are seeing extreme valuations that are reminiscent of the dot-com bubble of the late 1990s."

One of the key factors Gundlach points to is the low-interest-rate environment. "When interest rates are low, it's harder to find attractive investment opportunities," he explains. "This leads investors to take on more risk, driving up stock prices."

The Impact of Inflation

Gundlach also emphasizes the impact of inflation on the stock market. "Inflation is a significant threat to the stock market," he warns. "When inflation rises, it erodes the purchasing power of investors' returns."

He predicts that inflation will continue to rise in the coming years, driven by factors such as supply chain disruptions and rising energy prices. "This could lead to a significant market correction," he says.

Sector-Specific Insights

Gundlach has also provided specific insights into various sectors of the stock market. For instance, he has expressed skepticism about the technology sector, which has been one of the strongest performers in recent years.

"I think the technology sector is overvalued," he says. "We are seeing a lot of speculative investing in this sector, which could lead to a significant pullback."

On the other hand, Gundlach is bullish on the healthcare sector. "Healthcare is a sector that is likely to benefit from the aging population and increasing demand for medical services," he explains.

Predictions for the Future

Looking ahead, Gundlach predicts that the US stock market could face significant challenges. "I believe we are in for a period of market volatility," he says. "Investors should be prepared for a potential market correction."

He advises investors to focus on quality companies with strong fundamentals and to avoid speculative investments. "It's important to be selective and to avoid overvalued stocks," he adds.

Case Study: The Dot-Com Bubble

To illustrate his point, Gundlach often refers to the dot-com bubble of the late 1990s. "The dot-com bubble was a classic example of speculative investing," he explains. "Investors were driven by hype and ignored fundamental analysis."

The bubble eventually burst, leading to a significant market correction. "This is a lesson that investors should remember," he warns.

Conclusion

Jeffrey Gundlach's insights on the US stock market are valuable for investors and analysts alike. His concerns about overvaluation and inflation, as well as his sector-specific insights, provide a comprehensive view of the current market landscape. As always, investors should be cautious and selective in their investments, keeping in mind Gundlach's predictions for the future.