Are you a Canadian investor looking to diversify your portfolio by investing in US stocks? Investing in American companies can be an excellent way to capitalize on the strong and stable economy, as well as the vast array of companies that offer unique opportunities. However, navigating the differences in regulations, currency, and investment strategies can be daunting. In this article, we'll explore the best ways for Canadians to invest in US stocks, ensuring that you make informed and profitable decisions.

Understanding the Basics

Before diving into the specifics of how to invest, it's essential to understand the basics. US stocks are shares of ownership in a company that trade on American stock exchanges. Canadian investors have a few different options to purchase these stocks, each with its own advantages and disadvantages.

Direct Purchase of US Stocks

One of the most straightforward ways for Canadians to invest in US stocks is by purchasing them directly. This can be done through a Canadian brokerage firm that offers access to American exchanges.

Pros:

- Direct ownership of the stock.

- Potential for significant capital gains.

- Access to a wide range of American companies.

Cons:

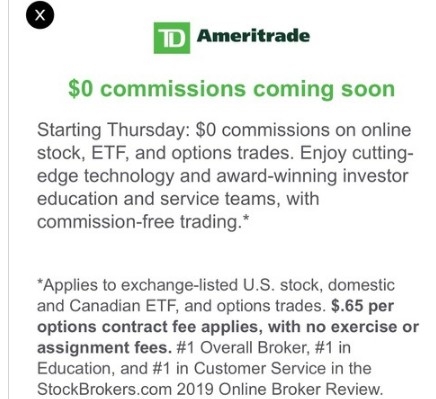

- Potential for higher transaction fees.

- Exchange rate fluctuations can impact returns.

- Tax implications need to be considered.

Canadian Dividend Stocks

Another popular option is to invest in Canadian dividend stocks that generate income from their investments in US companies.

Pros:

- Regular dividend payments.

- Exposure to the American market without the complexities of direct stock purchases.

- Tax-efficient for Canadian investors.

Cons:

- Limited to the stocks available on Canadian exchanges.

- Potential for less diversification compared to direct purchases.

ETFs and Mutual Funds

Exchange-Traded Funds (ETFs) and mutual funds are also excellent options for Canadian investors looking to invest in US stocks. These funds are managed by professionals and offer diversification, which can reduce risk.

Pros:

- Diversification and professional management.

- Easy to buy and sell.

- Access to a wide range of American stocks through a single investment.

Cons:

- Potential for higher fees compared to direct purchases.

- May not offer the same level of tax efficiency as dividend stocks.

Considerations for Canadian Investors

When investing in US stocks, Canadian investors should consider several factors:

- Currency Fluctuations: US dollar fluctuations can impact returns. It's important to monitor the exchange rate and understand how it will affect your investments.

- Tax Implications: Canadian investors are subject to Canadian taxes on income from US stocks. Understanding the tax implications can help you plan accordingly.

- Research: Thorough research on the companies you're interested in is crucial. Look for companies with strong fundamentals and a solid track record.

Case Study: Investing in Apple Inc.

Consider the case of Apple Inc., one of the most popular American companies. A Canadian investor might choose to purchase Apple stock directly through a brokerage firm. This would give them direct ownership of the stock, allowing them to benefit from any increase in share price. Additionally, if Apple pays dividends, the investor would receive regular payments.

In conclusion, investing in US stocks can be a rewarding venture for Canadian investors. By understanding the different investment options, considering the unique factors involved, and conducting thorough research, you can make informed decisions that align with your investment goals and risk tolerance.