In the vast landscape of the US stock exchange, various sectors offer investors a diverse range of opportunities. Understanding these sectors is crucial for making informed investment decisions. This article delves into the key sectors of the US stock exchange, highlighting their characteristics, strengths, and potential risks.

Technology Sector

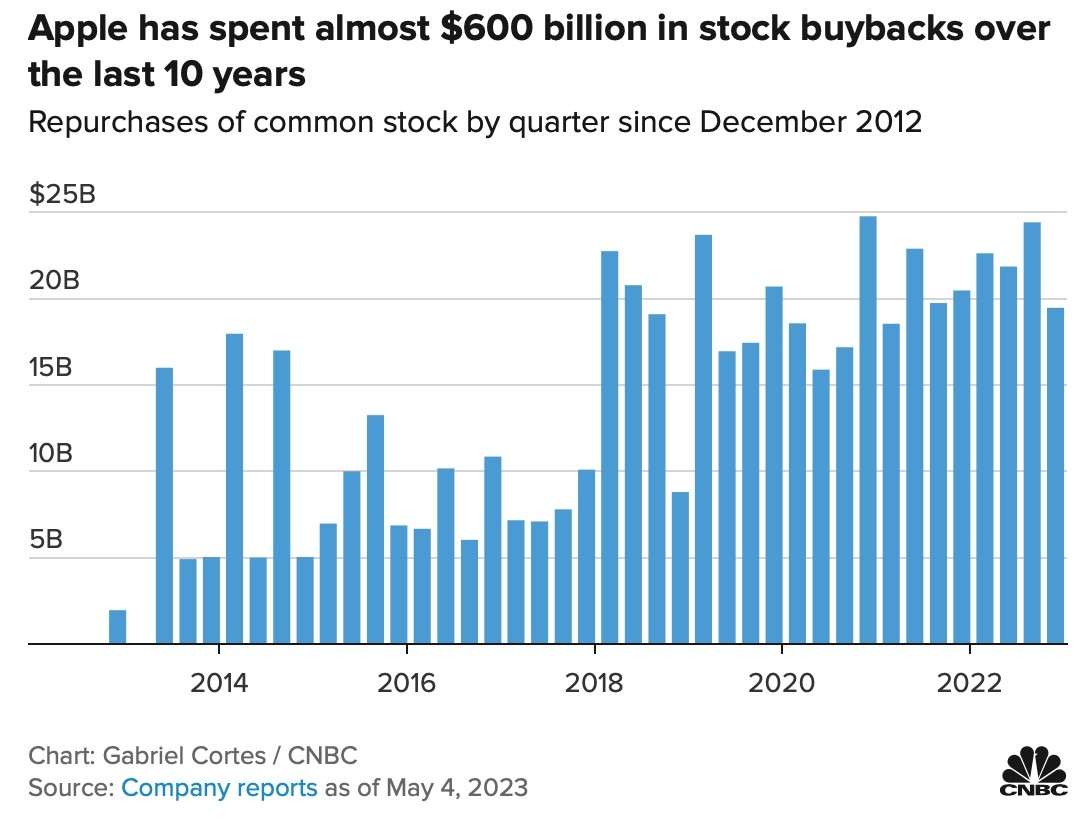

The technology sector is one of the most dynamic and influential sectors in the US stock exchange. It encompasses companies involved in the development, manufacturing, and distribution of technology products and services. This sector includes giants like Apple, Microsoft, and Google.

Strengths:

- Innovation: The technology sector is known for its constant innovation, leading to new products and services.

- Market Demand: As technology becomes an integral part of our lives, the demand for tech products and services continues to grow.

Risks:

- Regulatory Changes: The sector is subject to regulatory changes that can impact the operations of companies.

- Market Volatility: The technology sector is known for its high volatility, which can lead to significant price fluctuations.

Financial Sector

The financial sector is another major sector in the US stock exchange. It includes companies involved in banking, insurance, real estate, and investment services. This sector is characterized by its stability and profitability.

Strengths:

- Stability: The financial sector is known for its stability, making it a preferred choice for conservative investors.

- Diversification: The sector offers a wide range of investment opportunities, including stocks, bonds, and mutual funds.

Risks:

- Economic Sensitivity: The financial sector is highly sensitive to economic changes, which can impact its performance.

- Regulatory Changes: Similar to the technology sector, the financial sector is subject to regulatory changes.

Healthcare Sector

The healthcare sector is a vital part of the US stock exchange. It includes companies involved in the development, manufacturing, and distribution of healthcare products and services. This sector is characterized by its growth potential and innovation.

Strengths:

- Growth Potential: The healthcare sector is expected to grow at a steady pace due to an aging population and increasing healthcare needs.

- Innovation: The sector is known for its constant innovation, leading to new treatments and technologies.

Risks:

- Regulatory Changes: Similar to the technology and financial sectors, the healthcare sector is subject to regulatory changes.

- Market Volatility: The sector can experience significant price fluctuations due to market dynamics.

Consumer Goods Sector

The consumer goods sector includes companies involved in the production and distribution of consumer products. This sector is characterized by its broad market reach and diverse product offerings.

Strengths:

- Market Reach: The consumer goods sector has a wide market reach, making it a stable investment option.

- Brand Power: Many companies in this sector have strong brand power, which helps in maintaining customer loyalty.

Risks:

- Market Saturation: The consumer goods sector can experience market saturation, leading to intense competition.

- Economic Sensitivity: The sector is sensitive to economic changes, which can impact consumer spending.

Understanding the different sectors of the US stock exchange is essential for making informed investment decisions. Each sector has its unique characteristics, strengths, and risks. By diversifying your investments across different sectors, you can potentially mitigate risks and maximize returns.