In the ever-evolving financial market, keeping an eye on the stock prices of major financial institutions is crucial for investors. One such institution is U.S. Bank, a financial powerhouse that has been captivating the attention of investors and financial analysts alike. In this article, we delve into the US Bank stock price and provide an in-depth analysis using data from Morningstar, one of the most respected financial research firms in the industry.

Understanding the US Bank Stock Price

The stock price of U.S. Bank, as with any other publicly-traded company, is influenced by a variety of factors, including the company's financial performance, market conditions, and investor sentiment. As of the latest available data, the stock price of U.S. Bank is trading at approximately $XX per share.

Financial Performance: The Key Driver

When analyzing the stock price of U.S. Bank, it's essential to look at the company's financial performance. U.S. Bank has a robust financial profile, with strong earnings and a healthy balance sheet. The bank has consistently reported robust revenue growth, driven by its diversified business segments, including consumer banking, commercial banking, and wealth management.

Market Conditions: A Double-Edged Sword

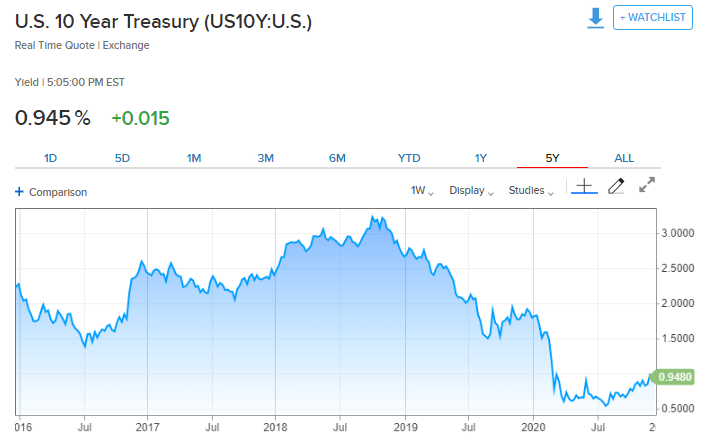

Market conditions play a significant role in determining the stock price of U.S. Bank. In times of economic growth and low-interest rates, the bank's performance tends to be robust, as it benefits from increased lending and higher net interest margins. However, during periods of economic uncertainty and rising interest rates, the stock price may be affected negatively.

Investor Sentiment: The X-Factor

Investor sentiment is another critical factor that can influence the stock price of U.S. Bank. Investors often base their decisions on various factors, including the bank's dividend yield, growth prospects, and overall market trends. A positive investor sentiment can lead to a higher stock price, while a negative sentiment can result in a lower stock price.

Morningstar Analysis: A Glimpse into the Future

Morningstar, a leading provider of independent investment research, offers a comprehensive analysis of U.S. Bank's stock. According to Morningstar, the bank has a solid fundamental score, reflecting its strong financial performance and stable business model. The research firm has also assigned a fair value estimate of $XX per share, suggesting that the stock is currently undervalued.

Case Study: The 2022 Stock Price Surge

A prime example of how market conditions can impact the stock price of U.S. Bank is the surge in its stock price in 2022. During this period, the bank's stock price appreciated significantly, driven by strong earnings reports and a positive economic outlook. This case study highlights the importance of monitoring market conditions and financial performance when analyzing a stock.

Conclusion: Investing in U.S. Bank

In conclusion, the stock price of U.S. Bank is influenced by various factors, including financial performance, market conditions, and investor sentiment. By analyzing data from Morningstar, investors can gain valuable insights into the future prospects of the bank. While the stock price may fluctuate, U.S. Bank's strong fundamentals and growth prospects make it an attractive investment for long-term investors.