Are you considering investing in US stocks but unsure whether it's the right move? You're not alone. With the stock market's volatility and the myriad of options available, making an informed decision can be challenging. In this comprehensive guide, we'll explore the factors you should consider before deciding whether to buy US stocks.

Understanding the US Stock Market

The US stock market is one of the largest and most diverse in the world. It offers a wide range of investment opportunities, from large-cap companies like Apple and Microsoft to small-cap startups with high growth potential. However, it's essential to understand that investing in stocks involves risks, including the possibility of losing your investment.

Factors to Consider Before Buying US Stocks

Economic Conditions: The state of the economy can significantly impact the stock market. For instance, during a recession, many companies may experience a decline in profits, leading to a drop in stock prices. Conversely, during an economic boom, stocks may perform well.

Company Performance: Analyze the financial performance of the company you're considering investing in. Look at factors like revenue growth, profit margins, and debt levels. Companies with strong financials are more likely to perform well in the stock market.

Market Trends: Stay informed about market trends and how they might affect the stocks you're interested in. For example, if the market is in a bull phase, stocks may perform well, while during a bear phase, they may decline.

Dividends: Consider companies that offer dividends. Dividends provide investors with a regular income stream and can be a sign of a company's financial stability.

Risk Tolerance: Assess your risk tolerance before investing. If you're risk-averse, you may want to invest in blue-chip companies with a strong track record. On the other hand, if you're willing to take on more risk, you might consider investing in smaller, high-growth companies.

Case Studies

Let's look at a couple of case studies to illustrate the points mentioned above.

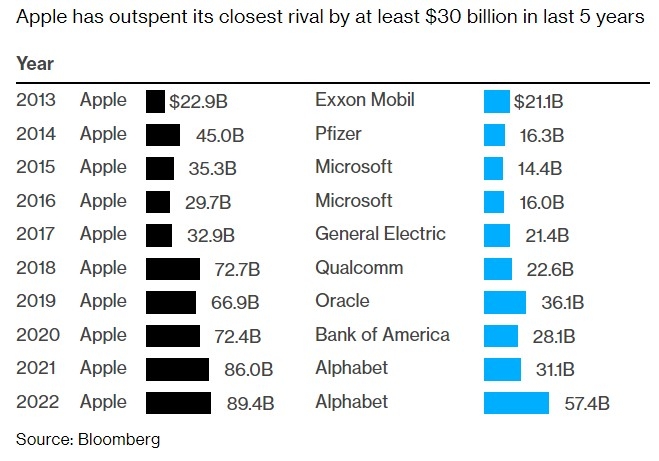

Apple Inc.: Apple is a well-known example of a company that has performed well over the years. Despite facing challenges, such as supply chain disruptions and competition, Apple has continued to grow its revenue and profits. Investors who bought Apple stock years ago have seen significant returns.

Tesla Inc.: Tesla is a prime example of a high-growth company. While it has experienced volatility in its stock price, investors who bought Tesla stock early on have seen substantial gains. However, it's important to note that Tesla's stock is riskier than that of established companies like Apple.

Conclusion

Deciding whether to buy US stocks requires careful consideration of various factors. By understanding the market, analyzing company performance, and assessing your risk tolerance, you can make an informed decision. Remember, investing in stocks is a long-term endeavor, and patience and discipline are key to achieving success.

Keywords: US stocks, investing, stock market, economic conditions, company performance, market trends, dividends, risk tolerance, Apple Inc., Tesla Inc.