In today's global financial landscape, the US dollar remains a powerhouse currency. Its strength has a significant impact on various aspects of the economy, including stock market investments. Understanding the buying power of the US dollar in stocks is crucial for investors looking to maximize their returns. This article delves into the concept of US dollar stock buying power, its implications, and how investors can leverage it to their advantage.

What is US Dollar Stock Buying Power?

US dollar stock buying power refers to the amount of goods, services, or assets an investor can purchase with a certain amount of US dollars. Essentially, it's a measure of the purchasing power of the US dollar in the context of stock market investments. When the US dollar is strong, investors can buy more stocks with the same amount of money, potentially leading to higher returns.

Why is US Dollar Strength Important for Stock Investments?

Several factors make the strength of the US dollar crucial for stock investments:

- Inflation: A strong dollar can help mitigate the effects of inflation. When the dollar is strong, the cost of goods and services tends to be lower, which can lead to lower inflation rates.

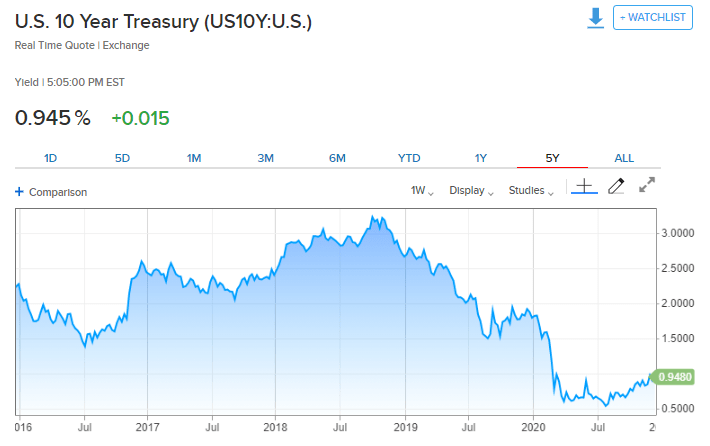

- Interest Rates: The Federal Reserve's monetary policy often influences the value of the US dollar. Higher interest rates can strengthen the dollar, making it more attractive to foreign investors, which can lead to increased demand for US stocks.

- Currency Fluctuations: The value of the US dollar can fluctuate against other currencies. When the dollar is strong, US stocks become more affordable for foreign investors, potentially increasing demand and driving up stock prices.

Leveraging US Dollar Stock Buying Power

Here are some strategies investors can use to leverage the buying power of the US dollar in stocks:

- Diversification: Diversifying your portfolio across different sectors and geographic regions can help protect against currency fluctuations. Investing in companies with a global presence can also provide exposure to stronger currencies, potentially offsetting the effects of a weaker US dollar.

- International Investments: Investing in stocks from countries with strong currencies can enhance your buying power. For example, investing in stocks from the Eurozone or Japan may be more beneficial when the US dollar is strong.

- Dividend Stocks: Investing in dividend-paying stocks can provide a steady stream of income. Companies with strong financials and a history of paying dividends can be attractive investments, especially when the US dollar is strong.

Case Studies

Let's look at a couple of case studies to illustrate the impact of US dollar stock buying power:

- Apple Inc. (AAPL): When the US dollar was strong, Apple's stock became more attractive to foreign investors. This led to increased demand and a rise in stock prices.

- Tesla Inc. (TSLA): As the US dollar strengthened, Tesla's stock became more affordable for foreign investors, leading to higher demand and increased stock prices.

Conclusion

Understanding the buying power of the US dollar in stocks is essential for investors looking to maximize their returns. By leveraging the strength of the US dollar and adopting effective investment strategies, investors can navigate the complexities of the stock market and achieve their financial goals.