Introduction

The US stock market has always been a beacon of economic activity and investor sentiment. On January 17, the market witnessed several significant developments that could shape the future of investments. In this article, we delve into the key happenings and insights from the day, offering a comprehensive overview of the US stock market.

Market Overview

On January 17, the US stock market opened on a cautious note, following a mixed performance in the previous week. The major indices, including the S&P 500, Dow Jones, and NASDAQ, experienced volatility, reflecting investor concerns and market uncertainties.

1. Key Developments

- Tech Stocks: Tech giants like Apple, Microsoft, and Google witnessed a surge in their shares, driven by strong earnings reports and positive market sentiment. This was a welcome sign for investors who had been concerned about the tech sector's recent decline.

- Energy Sector: The energy sector saw a significant boost, primarily due to rising oil prices. Companies like ExxonMobil and Chevron reported strong quarterly results, contributing to the overall market performance.

- Consumer Discretionary Stocks: The consumer discretionary sector experienced a downturn, with companies like Disney and Home Depot facing challenges due to higher input costs and supply chain disruptions.

- Earnings Reports: Several companies, including Walmart and Target, reported their quarterly earnings, with mixed results. While Walmart exceeded expectations, Target missed estimates, reflecting broader economic concerns.

2. Market Insights

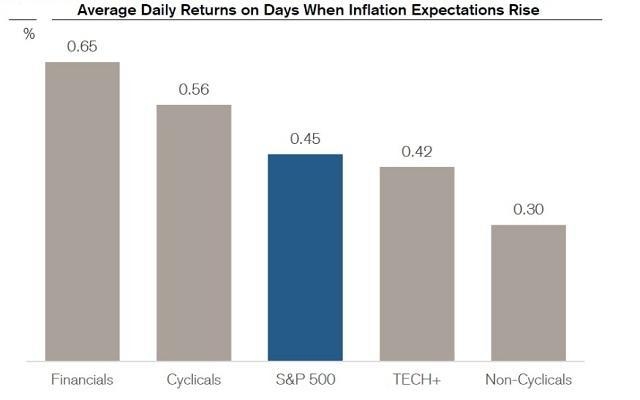

- Inflation Concerns: The market remained concerned about inflation, with the Consumer Price Index (CPI) expected to rise in the coming months. This could potentially impact consumer spending and corporate earnings.

- Economic Growth: The US economy showed signs of slowing growth, with the Federal Reserve indicating a possible interest rate hike in the near future. This could have a bearing on the stock market's performance.

- Geopolitical Tensions: The ongoing tensions in the Middle East and the situation in Eastern Europe continued to create uncertainty in the market, with investors closely monitoring geopolitical developments.

3. Case Studies

- Apple: Apple's strong earnings report and positive outlook for the coming quarters contributed to a surge in its shares. The company's success in the iPhone market and expansion into other product categories like wearables and services played a crucial role in its performance.

- ExxonMobil: The energy giant's robust quarterly results and commitment to capital investments in the energy sector helped drive the energy sector's performance. The company's focus on innovation and sustainability also attracted investors.

Conclusion

The US stock market's performance on January 17 reflected a mix of optimism and caution. While certain sectors like tech and energy experienced growth, others like consumer discretionary faced challenges. Investors should stay vigilant and closely monitor market developments to make informed decisions.