In the dynamic world of real estate investment, Macerich US real estate stocks have emerged as a compelling choice for investors seeking to diversify their portfolios. Macerich, a renowned real estate investment trust (REIT), specializes in owning and operating a diverse portfolio of retail properties across the United States. This article delves into the intricacies of Macerich US real estate stocks, offering insights into their potential, risks, and the factors that influence their performance.

Understanding Macerich US Real Estate Stocks

Macerich, founded in 1924, is one of the largest REITs in the United States. The company owns a portfolio of approximately 400 retail properties, spanning approximately 70 million square feet. These properties are strategically located in prime retail markets across the country, including California, New York, and the District of Columbia.

Macerich's focus on retail properties, particularly in high-demand markets, has made it a preferred investment choice for many investors. The company's diverse portfolio includes shopping centers, malls, and mixed-use developments, offering a range of investment opportunities.

Key Factors Influencing Macerich US Real Estate Stocks

Several factors can influence the performance of Macerich US real estate stocks. Here are some of the most significant:

- Economic Conditions: The health of the economy significantly impacts the performance of Macerich's properties. A robust economy typically leads to increased consumer spending, which benefits retail properties.

- Retail Sector Trends: Changes in consumer behavior, such as the rise of e-commerce, can impact the performance of retail properties. Macerich's ability to adapt to these trends is crucial for its success.

- Property Valuations: The valuation of Macerich's properties can significantly influence its stock price. Factors such as occupancy rates, rental income, and property values play a vital role in determining the company's market value.

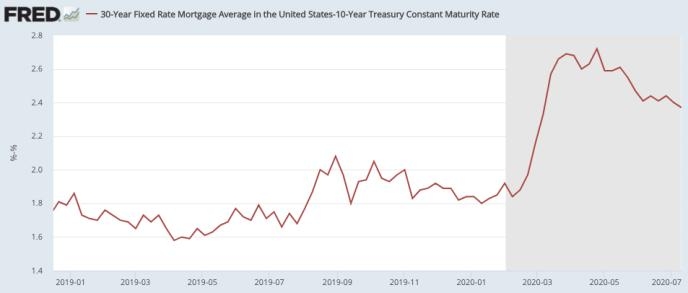

- Interest Rates: Changes in interest rates can impact the cost of financing for Macerich and its tenants, affecting the company's overall performance.

Macerich US Real Estate Stocks: Performance and Potential

Over the years, Macerich US real estate stocks have demonstrated strong performance, with the company consistently delivering robust returns to its investors. However, it is important to note that the performance of these stocks can be influenced by various factors, as mentioned earlier.

One notable aspect of Macerich's performance is its focus on high-quality retail properties in prime locations. This strategy has enabled the company to maintain strong occupancy rates and rental income, contributing to its overall success.

Additionally, Macerich has shown a commitment to diversifying its portfolio, acquiring properties in various retail sectors and geographic locations. This diversification has helped mitigate risks associated with specific market segments or geographic regions.

Case Study: Macerich's Acquisition of Westfield

A prime example of Macerich's strategic approach is its acquisition of Westfield Corporation in 2015. This acquisition expanded Macerich's portfolio, adding high-quality retail properties in key markets across the United States and Australia. The integration of Westfield's assets into Macerich's portfolio has contributed to the company's growth and enhanced its market position.

Conclusion

Macerich US real estate stocks offer a unique opportunity for investors looking to invest in the retail real estate sector. With a diverse portfolio of high-quality properties, a strong track record of performance, and a strategic approach to growth, Macerich presents an attractive investment option. However, as with any investment, it is essential to conduct thorough research and consider the various factors that can influence the company's performance.