The recent selloff on Wall Street has caused a stir among investors, but the US stock futures have shown signs of stabilization. This article delves into the factors contributing to this stabilization and offers insights into the future of the stock market.

Market Dynamics

The sudden selloff on Wall Street was triggered by a variety of factors, including concerns about rising inflation, geopolitical tensions, and the potential impact of the Federal Reserve's monetary policy. However, despite the initial panic, the US stock futures have shown remarkable resilience.

Inflation Concerns

One of the primary reasons for the selloff was the rising inflation rates. The Consumer Price Index (CPI) has been on the rise, causing concerns about the potential for higher interest rates. This has led to a sell-off in stocks, as investors worry about the impact of higher borrowing costs on corporate earnings.

Geopolitical Tensions

Another factor contributing to the selloff was the escalating geopolitical tensions, particularly between the United States and China. These tensions have raised concerns about global trade and economic stability, leading to a sell-off in stocks.

Monetary Policy

The potential impact of the Federal Reserve's monetary policy was also a significant factor. The Fed has indicated that it may raise interest rates to combat inflation, which has caused investors to sell off stocks in anticipation of higher borrowing costs.

Stabilization Efforts

Despite these concerns, the US stock futures have shown signs of stabilization. This can be attributed to several factors:

- Economic Data: The latest economic data has shown that the US economy is still growing, despite the rising inflation rates. This has helped to stabilize investor sentiment.

- Corporate Earnings: Many companies have reported strong earnings, which has helped to boost investor confidence.

- Central Bank Support: Central banks around the world have been supportive of the stock market, indicating that they are willing to take action to stabilize the economy.

Case Studies

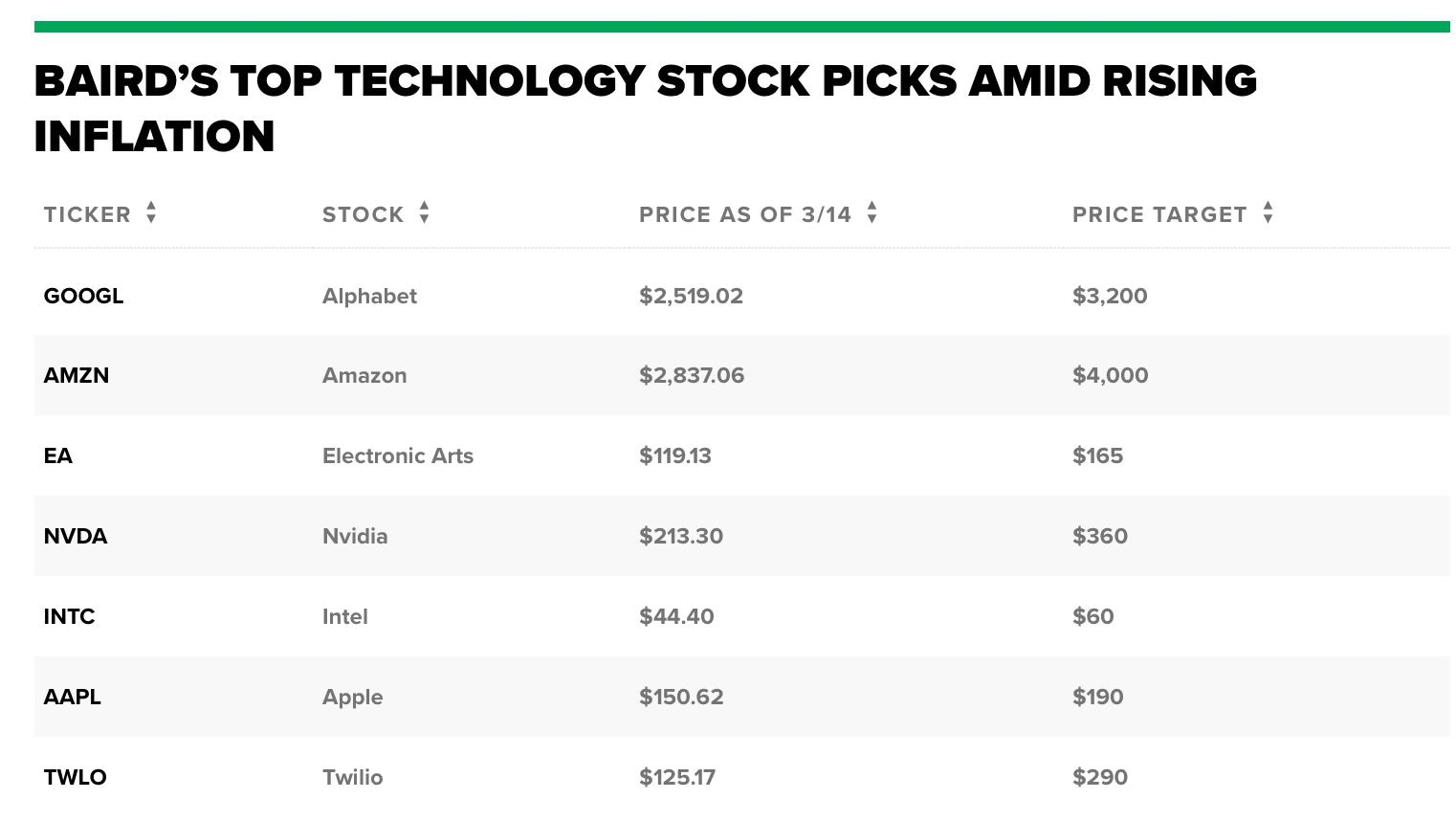

One notable case study is the tech sector, which has been particularly resilient despite the selloff. Companies like Apple and Microsoft have reported strong earnings, which has helped to stabilize investor sentiment in this sector.

Another case study is the energy sector, which has been negatively impacted by the geopolitical tensions. However, companies like ExxonMobil and Chevron have shown resilience, indicating that the sector may be on the rebound.

Conclusion

The recent selloff on Wall Street has caused concerns among investors, but the US stock futures have shown signs of stabilization. This can be attributed to a variety of factors, including economic data, corporate earnings, and central bank support. While the future remains uncertain, the current signs indicate that the US stock market may be on the path to recovery.