Introduction:

The relationship between recessions and the US stock market has always been a subject of intense interest and debate among investors and economists alike. While recessions are a natural part of the economic cycle, they often have a profound impact on the stock market, leading to significant fluctuations in investor sentiment and market performance. In this article, we will explore the dynamics of this relationship, discuss key factors that influence the stock market during recessions, and provide some insights into how investors can navigate these challenging times.

Understanding Recessions:

Firstly, let's define what a recession is. A recession is typically characterized by a significant decline in economic activity, often measured by a decline in GDP, increased unemployment, and reduced consumer spending. Recessions can be short-lived or prolonged, and their impact on the stock market can vary widely.

The Impact of Recessions on the Stock Market:

During a recession, the stock market tends to experience several key trends:

Stock Price Volatility: Recessions often lead to increased volatility in the stock market, with prices fluctuating widely as investors react to changing economic conditions.

Sector Performance: Different sectors respond differently to recessions. Typically, defensive sectors like healthcare and consumer staples tend to perform better during economic downturns, while cyclical sectors like technology and financials may suffer more.

Earnings Declines: Companies often see a decline in earnings during recessions, as reduced consumer spending and increased business costs put pressure on profitability.

Dividend Cuts: Many companies may cut their dividends during recessions to conserve cash and reduce debt.

Key Factors Influencing the Stock Market During Recessions:

Several factors can influence the stock market during a recession:

Monetary Policy: Central banks often respond to recessions by lowering interest rates to stimulate economic growth. Lower interest rates can make stocks more attractive compared to other investment options.

Fiscal Policy: Government stimulus measures, such as increased spending or tax cuts, can help to mitigate the impact of a recession on the stock market.

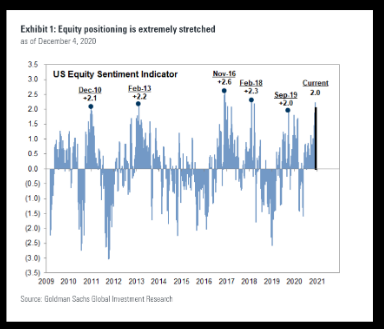

Market Sentiment: Investor sentiment can play a significant role in the stock market during a recession. Optimism can lead to stock price increases, while pessimism can drive prices down.

Case Studies:

To illustrate the relationship between recessions and the stock market, let's consider two case studies:

2008 Financial Crisis: The 2008 financial crisis was one of the most severe recessions in recent history. The stock market experienced significant volatility, with the S&P 500 index falling by over 50% from its peak in 2007 to its trough in 2009. However, the market eventually recovered, with the S&P 500 index reaching new highs by 2013.

2020 COVID-19 Pandemic: The COVID-19 pandemic caused a rapid and widespread recession. The stock market fell sharply at the start of the pandemic, with the S&P 500 index dropping by over 30% from its peak in February 2020. However, as the pandemic situation improved and governments implemented stimulus measures, the market recovered, with the S&P 500 index reaching new highs by the end of 2020.

Conclusion:

While recessions can be a challenging time for the stock market, they also present opportunities for investors. Understanding the relationship between recessions and the stock market can help investors make more informed decisions during these times. By paying attention to key factors such as monetary and fiscal policy, sector performance, and market sentiment, investors can navigate the complexities of the stock market during recessions and potentially achieve long-term success.